Dowladi waxa ay dakhliyo kala duwan ‘different income’ ka heshaa ilo kala gedisan ‘different source’. Dowladi ma shaqayn karto hadii aan dakhli jirin. Dakhliga na waxa ay ka heshaa dadka. Dowlad kasta oo dunida ka jirtaa dadkeeda waxa ay ka heshaa dakhli kala duwan oo ay ku socod siiso hawlaha qaranka (Implementation of national work). Dakhligu waa mishiinka dhaqaajiya shaqada dowlada, adeegyadda bulshada, iyo kaabayaasha dhaqaalaha. Noocyadda dakhli ee dowlad soo gala guud ahaan waxa lagu soo koobaa toddoba qaybood;

- Dakhliga cashuuraha (revenue from tax).

- Dakhliga adeega (revenue from service).

- Dakhliga deeqaha (revenue from grants).

- Dakhliga hantida dowlada (revenue from state assets).

- Dakhliga ganaaxyada (revenue from penalty).

- Dakhliga kaalmada (revenue from aid).

- Dakhliga deymaha (revenue from loans).

Waxa aynu qaadaa dhigi dakhliga cashuuraha oo ah tiirka koowaad ee aasaaska iyo seeska u ah habka dowladi dhaqaale ku hesho (Income Taxation is the most important source of government get from revenue) oo ah dakhliga cashuuraha. Maqaalka kaga bogo waxa ay tahay cashuurtu (government taxation), qaybaheeda kala duwan, ahmiyadda looga gol leeyahay iyo doorka ay ku leedahay qaran dhiska dowladnimo ee dowladaha (nation building). Qoraalka si qotodheer waxa aynu diirada ku saari ilaha dakhli cashuureed ee dowlad soo gala, noocyadda cashuuraha, hanaanka xadiga, tabaha iyo hababka kala gedisan ee ay dowladi cashuur u ururiso.

Waa Maxay Cashuurto ama Dakhli Cashuureedku?

Cashuurtu waxa ay ka mid tahay dakhliga, tiirarka dhaqaale iyo maaliyadeed ee dowlada. Cashuurtu waa waajibaad lacag bixineed ee sharci ah oo laga wareejinayo dhaqaalaha gaar ahaaneed loona wareejinayo dakhliga guud ee qaranka, si loogu fuliyo waajibaadka hawleed ee dowladu bulshada u hayso (to implement the function of government to the society). Cashuurtu waa qaadhaan qaran oo bulshaddu ku khasban tahay inay bixiso si dalka iyo dadku u horumaro. Cashuurtu waxa ay aasaas iyo sees u tahay diyaarinta dowlada ee dhammaan adeegyadda bulshada, iyo dhisidda kaabayaasha nolosha iyo dhaqaalaha. Cashuurta luuqadda dhaqaalaha ee Ingiriiska waxa lagu qayaxaa “Taxation is compulsory financial charges that government imposes to the citizen and their business”.

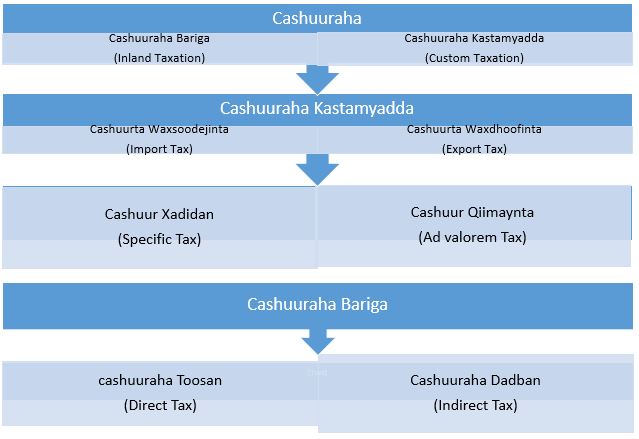

Si guud cashuurtu marka laga hadlayo afar meelood ayay ku dhacdaa, in ay ku dhacdo dakhliga (income), hantida (property), adeega (service), iyo badeecada (commodity). Cashuurta la dulsaaro dakhliga qofka, macaashka shirkadaha iyo faa’idada meherada ee tooska u taabanaysa faa’idada iyo raasamaalka dakhliga waxa la yidhaa cashuurta tooska ah (Direct Tax), waana cashuurta ku dhacaysa dakhliga iyo hantida. Cashuurta la saaro sicirka alaabta iyo adeega waxa la yidhaa cashuurta dadban (Indirect Tax), waana khidmada cashuurta ee laga qaadayo adeega iyo badeecada. Siyaabo kala duwan ayaa loo qaybiyaa noocyada cashuurta se anigu waxa aan soo qaadanayaa habkani cashuurta waxa loo qaybiyaa laba waaxood oo waaweyn;

- Cashuuraha Katamyada.

- Cashuuraha Bariga.

Laamaha cashuuraha dowladda waxa loo kala saaraa cashuuraha dowladda dhexe (Central government) iyo cashuuraha dowladaha hoose (Chancellorship’s). Ururinta cashuurta dowladda waxa kala ururiya ama qabtana dowladda dhexe iyo dowladaha hoose ee dalka. Dowladda dhexe waxa si gaara ugu xilsaaran wasaaradda maaliyada/dakhliga, hay’adaha dakhliga soosaara, hay’adda cashuuraha bariga iyo kastamyada. Dowladda hoose waxa u qaabilsan ururinta Waaxda Cashuuraha iyo Maaliyadda ee degmada.

Xadigga Hanaanka Cashuurta (Principle Rate of Taxation)

Xadigga hanaanka caashuurta saddex qaybood ayaa loo kala saaraa;

- Proportional tax: waa cashuur siman oo xaddi isku mid ah laga qaadayo iyada oo aan la eegayn xadiga dakhli qofka, shirkada iyo meherada ganacsi.

- Progressive tax: waa cashuur markasta oo dakhligu kordho ay badanayso cashuurtu la qaadayaa.

- Regressive tax: waa cashuur markasta oo dakhligu hooseeyo ay yaraanayso cashuurta xadiga la qaadayaa.

Ujeedada Cashuurta (Objective of Taxation)

Waa maxay ujeedada ay dowladi cashuur u qaado? Si kooban cashuurta dowladi qaadato laba ujeedo ayay ka leedahay 1) ujeedada koowaad “primary purpose” iyo 2) ujeedada labaad “Secondary Purpose”.

Ujeedadda Koowaad

- In dakhliga dowlada kor u qaado (to raise revenue).

- In ay bixiso adeegyadda bulshadda ah ee aasaasiga (to provide social service’.

- In ay ku hormariso danaha qaranka (to develop state interest).

- In ay ku dhisto kaabayaasha dhaqaalaha (to build infrastructure).

- In ay ku abuurto fursado shaqo (to create job opportunity).

- In ay ku horumariso dhaqaalaha qaranka (to promote nation economy).

- In ay ku sugto amniga dadka iyo dalka (to keep/secure security of people and state).

- In ay ku suurtogaliso kala dambaynta iyo ku dhaqanka sharciga (rule of law)

- In ay ku fuliso ama dhisto mashaariico horumarineed (to enforce project developments).

- Ujeedadda Labaad

- Gargaarida Hawlaha Aadantinimo ee dunidda dacaladeeda.

- Fulinta danaha qaranka ee dibada.

- Kaalmo siinta dalalka kale ee dunida.

- Ka jawaabida xaaladaha degdega ah.

Magacyadda Cashuuraha

| 1. Cashuurta Maalinlaha Ah | Daily Tax |

| 2. Cashuurta Iibka | Sale’s Tax |

| 3. Cashuurta Wado-marista | Road Tax |

| 4. Cashuurta Ruqsadaha | Concession Tax |

| 5. Cashuurta Diwaangelinta | Registration Tax |

| 6. Cashuurta Kirada | Rental Tax |

| 7. Cashuurta Hantida | Property Tax |

| 8. Cashuurta Duuduubka | Gross Turnover Tax |

| 9. Cashuur Shaamada | Stamp Tax |

| 10.Cashuurta Madadaalada | Entertainment Tax |

| 11.Cashuurta Beeraha | Farm Tax |

| 12.Cashuurta Dhaxalka | Inheritance Tax |

| 13.Cashuurta Dhoofaka | Departure Tax |

| 14.Cashuurta Soo galida dalka | Arrival Tax |

| 15.Cashuur Sanadeedka | Annual Year tax |

| 16.Cashuurta Mushaharka Shaqaalaha Dowlada | Civil Payroll Tax |

| 17.Cashuurta Mushaharka Shaqaalaha Ajaanibka | Foreign Payroll tax |

| 18.Cashuurta Mushaharka Shaqaalaha Rayidka | Civilian Payroll Tax |

| 19.Cashuurta Dakhliga Shirkada | Corporate Income Tax |

| 20.Cashuurta Dakhliga Qofka | Personal Income Tax |

| 21.Cashuurta Khidmada Cisbitaalka | Hospital Fee Tax |

| 22.Cashuurta Khidmada Maxkamadda | Court Fee Tax |

| 23.Cashuurta Suuqa | Market Tax |

| 24.Cashuurta Khidmada Baasaboorka | Passport Fee Tax |

| 25.Cashuurta Ardiyada Dhulka | Land Tax |

| 26.Cashuurta Qiimaynta | Ad Volerm Tax |

| 27.Cashuurta Gaarka Ah | Excise Tax |

| 28.Cashuurta Faa’idul Faa’idada | Capital Gain Tax |

| 29.Cashuurta Dekeda | Harbor Tax |

| 30.Cashuurta Adeega Dekedda | Port Service Tax |

| 31.Cashuurta Khidmada Ogolaanshaha | Permission Fee Tax |

| 32.Cashuurta Mushaaxida Hawada | Air Navigation Tax |

| 33.Cashuurta Khidmada Xajka | Embrocation Fee Tax |

| 34.Cashuurta Khidmada Tikidhada | Ticket Fee Tax |

| 35.Cashuurta Dalxiiska | Tour Tax |

| 36.Cashuurta Wakhtiga Dheeriga ah | Overtime Tax |

| 37.Cashuurta Sinaanta | Flat Tax |

| 38.Cashuurta Macaashka Kirada Guryaha | Real Estate Tax |

| 39.Cashuurta Qiimaha Dhulka | Land Value Tax |

| 40.Cashuurta Qiimaha Guryaha | House Value Tax |

| 41.Cashuurta Diwaangalinta Dadweynaha | People Registration Tax (PRT) |

| 42.Cashuurta Isticmaalka Adeega iyo badeecada | Good and Service Tax (GST) |

| 43.Cashuurta Khidmada Mashaariicda | Project Fee Tax |

| 44.Cashuurta Calaamadaha Ganacsiga | Sing Board Tax |

| 45.Cashuurta Waxsoosaarka Gudaha | Internal Alimenting Tax |

| 46.Cashuurta waxdhoofinta | Export Tax |

| 47.Cashuurta waxsoodejinta | Import Tax |

| 48.Cashuurta Iibka Xoolaha | Emolument Livestock Tax |

| 49.Cashuurta Kala wareejinta | |

| 50.Cashuurta Warbaahinta | Media Tax |

| 51.Cashuurta Xirfadlayaasha | Provisional Tax |

| 52.Cashuurta Socdaalka | Immigration Tax |

| 53.Cashuurta Gudubka Badeecadaha | Transit commodity Tax |

| 54.Cashuurta Khidmada Maamulka | Administrate Fee Tax |

| 55.Cashuurta Khidmada Kaluumaysiga | Pilosism Fee Tax |

| 56.Cashuurta Xakamaynta | Sin Tax |

| 57.Cashuuraha Kala Duwan | Miselenous Tax |

| 58.Ccashuurta Khayraadka | Resource Tax |

| 59.Cashuurta Adeega | Taxable Service |

| 60.Cashuurta Ganacsiga Dibeda | Foreign Trade Tax |

Xidhiidhka Cashuurta iyo Cashuur Bixiyaha

Hormarka dhaqaale ee dal wuxuu ku xidhan yahay arrimo badan oo ay ka mid tahay sida bulshadu u bixiso cashuuraha ku soo hagaaga. Garashada xil gudashadaasi ee bixinta cashuurto waxa ay dowlada iyo dadweynaha ba u fududaysaa in hormarka dalku taamilo qaado oo xidhiidh qoto adagi ka dhexeeyo cashuurta (dowlada) iyo cashuur bixiyahay (bulshada) isla xisaabtan adagina hanaqaado. Madaahiibta dhaqaaluhu waxa ay Xidhiidhka ka dhexeeya cashuurta iyo cashuur bixiyuhu ku misaalaan xidhiidhka ka dhexeeya waxsoosaarka iyo awoodda waxsoosaarka (Production & Production Ability).

Bashir Maxamed Bashir

Borama, Awdal

0634450487/0634538873

12-June-2020